In Antifragile, author Nassim Nicholas Taleb presents the argument that the opposite of fragile is not simply something that is unaffected by stress or pressure. He argues that there is a quality called antifragile where something actually improves as a result of that stress or pressure. Taleb categorizes things on a scale from fragile to antifragile, with a mid-point he calls robust.

When this idea is applied to trading, the first comparison that jumps out at us is between buy and hold investors and systematic trend following traders. Systematic trend following traders excel under extremely volatile situations, are virtually ignored by intellectuals in their field and are capable of handling deviations because they are not predictive in nature.

An Illustration of The Antifragile Concept

Taleb illustrates his concepts of fragile, robust, and antifragile through Greek and Roman mythology.

Fragile is represented by the story of Damocles, who was invited to a dinner at which there was a sword hanging over his head that was held up by a horse’s hair. Damocles is considered fragile because at any second the hair could snap dropping the sword onto him.

The concept of robust is represented by the Phoenix, which is a bird that is able to be reborn from its own ashes. No matter how many times you attempt to destroy the Phoenix, it continues to return to its original state, unharmed.

Antifragile is represented by the Greek Hydra, which had multiple heads. Every time one of its heads was chopped off, two more would grow back. Any attempt to hard this creature actually made it grow stronger. This is the core concept of antifragile.

An Application To Trading

One of the characteristics that can help measure the fragility of something is how it responds to volatility. This allows us to easily apply this concept to trading, because volatility is actually measured in most markets.

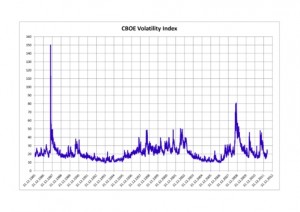

If we look at a long term chart of the VIX, we can see four distinct areas of extreme volatility: The Market Crash in 1987, The Asian Currency Crisis in 1997-98, The Dot-Com Bubble & Crash from 1998-2002, and the Financial Collapse in 2008. These highly volatile periods were high stress situations that would have made antifragile trading strategies better while making fragile strategies worse.

It is no coincidence that it was during these exact periods that systematic trend following traders posted some of their best years, and at the same time, buy and hold investors lost fortunes.

Systematic trend following strategies are not only built to handle these kinds of high stress, high volatility situations. They become stronger from them simply because they provide traders with a way to change direction. This ability to go with the flow during even the most chaotic times is a stark contrast to the rigidity of a buy and hold strategy where the investor has no choice but to sit and watch their portfolio crumble.

Overcompensation & Overreaction

“Intellectuals tend to focus on negative responses from randomness (fragility) rather than the positive ones (antifragility).” – Taleb

Again here, we can see a clear application of this with respect to trading during high volatility periods. In each of our four high volatility trading periods from the past 25 years, most of the intellectuals and so-called market experts were focused on the negative responses, which were the buy and hold investors who were losing their fortunes left and right.

During each of these periods, there was very little focus on traders who were benefiting from the increased volatility. The antifragile traders seemed to go unnoticed, and we know now that systematic trend following traders where the ones who were benefiting from these volatile markets.

Layers & Deviation

Taleb also discusses the complexities that can arise when looking at fragility through different layers and dimensions. He illustrates that since what is good for the antifragile is bad for the fragile, then what is good for the fragile is likely bad for the antifragile.

We have already discussed the huge success that antifragile trend following strategies have seen during times that were terrible for fragile buy and hold strategies. When the inverse situations occurs where markets have little volatility, we have seen that systematic trend followers and buy and hold investors can produce rather similar results. The key difference though, is that the antifragile systematic trend followers have the ability to adjust when a black swan shows up.

“When you are fragile, you depend on things following the exact planned course, with as little deviation as possible – for deviations are more harmful than helpful.” – Taleb

He continues to explain that the fragile is very predictive and that being so predictive is exactly what causes fragility. This is the problem with buying and holding with the expectation that a position will go up over time. The entire strategy is predictive in nature, and that is exactly why it becomes fragile. It can’t handle a deviation from what it predicts.

On the contrary, a systematic trend following approach can, by definition, handle any deviation from what is expected because it simply goes along with that deviation. This ability to adapt and change is magnified during periods of high volatility, which is when systematic trend following is at its best.

That is very helpful. The problem is we do not know when the extreme volatility will happen

You can have an intuitive idea. Right now is a great example. I wrote 2 months ago about how I expected high volatility in Cryptomania, and now look what’s happening.