Whenever currency pairs begin strong trending moves, traders will ask about the merits of the old trading adage, “the trend is your friend”. What does the trend have to offer? What not trade against the trend as well as with the trend and make pips going both ways?

A valid question to be sure…

While pips can be made trading counter trend, they will definitely come with a greater amount of risk.

Essentially, when taking trades in the direction of the trend, the trader has the “push”, the momentum of the market behind their trade. Since a major trading objective is to mitigate risk, one way we can do that is to eliminate trades that are against the prevailing trend.

When trading countertrend there is less momentum pushing in that direction since such a trade is going against the majority of traders in the market at the time. As such, the dominant trend can kick back in at any time quickly negating some/all profits which may have been earned by trading against the trend.

Also, when a trader knows that they have the “market behind their trade” when trading with the trend, they have more confidence to stick with the trade and let it mature as opposed to closing out the position too early.

Lastly, countertrend entries need to be much more precise since you are trying to time an entry while it is moving in the opposite direction that the market has been taking the pair over time. (Think of a relay race – is it easier/more forgiving to pass the baton to someone running in the same direction as you or someone running in the opposite direction?)

Entries with the trend can be much more forgiving.

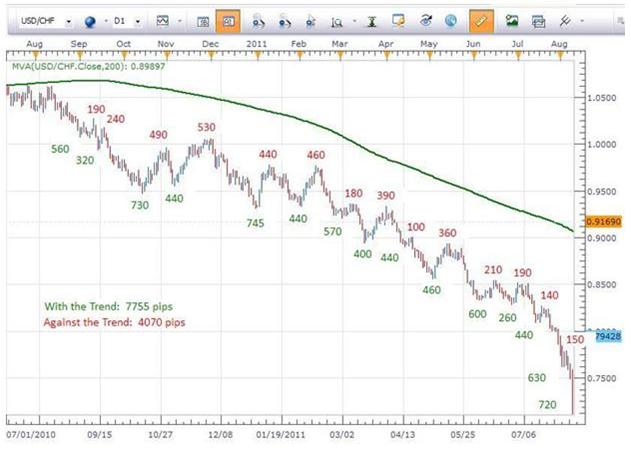

Let’s take a more in depth look at this idea using a historical Daily chart of the USDCHF as our example…

The approximate number of pips in each move to the downside – the direction of the overall trend – is shown in green. The approximate number of pips in each move to the upside – counter trend – is shown in red.

While we can definitely see that pips can be made trading countertrend, 4,070 in this example, there is a very significant difference in the number of pips earned by the trader who only took trades in the direction of the trend.

Based on this chart, trading only with the trend would have accumulated 7,755 pips – about 90% more.

Admittedly, 4,070 pips is nothing to turn up one’s nose at. For me however, factoring in the greater risk of more precise entries and the need to spend more time monitoring the trade even more closely, I’ll stick with trading in the direction of the trend.

RKrivoFX@gmail.com

@RKrivoFX